Pricing Elasticity Overview

Pricing strategy, in essence, is what makes money for your business. It can be the deciding factor behind your business losing money or being profitable, and affect how large your profit margins are. It is for this reason that it is necessary to have the pricing well optimized to make sure you are not losing money, as there might be pressure on shelf prices by your competitors, suppliers, and even by the customers. That’s why Price Elasticity is so important; when you look at any Economics 101 textbook, you will find the basic principle that states that Price Elasticity is the key to an optimal pricing strategy. However, understanding Price Elasticity becomes very tricky, very quickly–therefore applying it to your own pricing strategy makes it even more complex.

In this article, we will evaluate differing perspectives on the topic of Price Elasticity, and show you a better way to utilize it in your strategies. We will cover the limits inherent within Price Elasticity, and the factors that cause these limitations. We will then look into what information is needed for optimal pricing, and towards the end of the article, talk about how to utilize Price Elasticity within your own pricing strategy.

The Case Against Price Elasticity

Many factors can impact our perception of the effectiveness of price elasticities. For starters, there is likely more than one product that you’re selling, therefore cross-elasticities come into place. Promoting or just lowering the price of one product can attract more customers to purchase it, but it can also cannibalize the sales of its substitutes. Furthermore, support functions also exist between products, where inducing higher demand for one product will positively affect demand for others. For example, when promoting burgers in a grocery store, the sales of buns will increase without any change in their prices; the same occurs with gin and tonic, and countless other products that cross-sell virtually by default.

It goes without saying that there are more factors that influence customer purchasing behavior other than price. For example, promotional signs or prominent placement within stores typically have an even greater impact than price itself.

Considering the fact that you have competitors on the market, there surely will be an impact on your sales volumes resulting from the pricing decisions they make. In the online world, when the prices are above or below your competitors, it might have an immediate effect on sales. In physical stores, it may rather be a gradual change in sales quantities. Such a gradual change is nearly impossible to detect among all the other factors that are influencing sales, such as various trends, seasonalities, weather changes, or greater market shifts.

There are simply too many different factors affecting sales of individual articles to reliably quantify them all. Not only would it be extremely difficult to distinguish them, but there would never be enough data to achieve full quantification of every single SKU.

Also, don’t forget that time plays a major role as well. The behavior of customers changes over time–even the product portfolio changes, so it might be relatively safe to look for an example from the previous year. Within that period, only a limited amount of different scenarios occurred. Some articles possibly never changed their prices at all. In light of this all, it is no wonder that even large retailers choose to build their pricing strategies without greater insight from their data.

The Case for Price Elasticity

No retailer should ever lose focus on their customers. This is even more important when it comes to a key aspect of their business like their pricing strategy. But how can we include customers into the pricing? Well, you can obviously ask the customers directly, surveying their opinions about store personnel, products offered, and of course the prices.

However, the results of such surveys can never be detailed enough to build a pricing strategy for all articles individually. Moreover, conclusions from these kinds of surveys are notoriously skewed by the type of customers that participate, and what matters or factors truly influence them. Fortunately, there is a much less biased and more complete dataset of customers that answer the question “Would you buy this product for X price?”, and that is your full transaction history. Customers answer this question with their wallet, the most reliable source you can get!

Yet, how can we get around the problems from the previous paragraphs? There are simply too many factors at play, many of which even interact with one another leading to new variations, making this exponentially more intricate. Fortunately, mathematicians have been developing tools to help mitigate this issue for over a century in the field of statistics, specifically statistical modeling. Thanks to the computational power available today, we can now even work with datasets as large as those from chain retailers.

However, it is still not possible to incorporate all of these the factors together into one model and fully describe something as complex as human decision-making and customer behavioral patterns. When this becomes possible, we will be living in a vastly different world.

On the other hand, even today, we can achieve great results by cleverly combining multiple complex models that take into consideration all the important factors affecting your customers. That allows us, with various degrees of accuracy, to estimate the scale of those factors, including price elasticities and cross-elasticities. Let’s take advantage of that!

The Best of Both Worlds

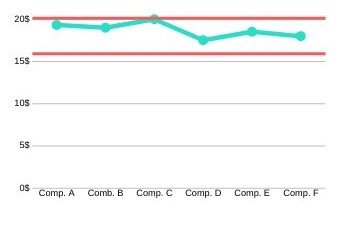

Now let’s say you’re creating a pricing strategy based on following the prices of your competitors. If you are an average player in the field you don’t want to be too expensive, nor too cheap. Therefore, you decide to price the products somewhere between the cheapest and the most expensive offer amongst your competitors. How do you decide which type of prices will work best? Will you use the average of their prices, or the median? Or, will you aggregate them in a different way? In any case, nobody can really tell what is the best option of all the ones available. There must be a better way, right?

Maybe some of the products are rather inelastic; customers don’t really remember their prices and will buy them regardless of the price being lower or higher. Increasing margin on those products is most likely the right decision, but you don’t want to go too far with it. Ideally, you would only increase margin within some reasonable boundaries to not exceed the range of prices of your competitors excessively. The same can happen the other way around when more of your customers do care about the price of a product and will buy it only when the price is lower.

How to Apply Pricing Elasticity to Your Strategy

Clearly, the best solution would be if someone (or something, for that matter) could consider all factors that influence pricing in order to find the optimal set of prices that achieve your goals. It would have to take into account factors like price elasticities, cross-elasticities, and their varying degree of accuracy while operating within reasonable price boundaries to ensure that you are following a set strategy. If you proceed in this wiser manner, it doesn’t matter if the strategy is based on following competitors, your margins, or something else.

Customers’ past purchasing behavior is the fundamental learning material that you can use for pricing. After changing prices, the customers will have different purchasing behavior. You can utilize this captured data for further price adjustments, but also to learn more about your customers.

That is exactly what we, at Yieldigo, provide to our retail grocery clients. We have developed an AI/ML pricing system that learns from past purchasing behavior of customers, and understands elasticity. Our software is also able to combine this with all of the other factors that influence purchasing behavior (seasonality, weather, competitors, cannibalization, promotions, etc.). Due to these specific capabilities, we are able to create optimal prices that will unprecedentedly increase the profit or the revenue of your business. In addition, our calculation of the expected sales impact of the price changes allows you to refine set price boundaries, test various alternative strategies and pricing approaches, and even steer each product category individually towards different optimization targets.

If you are interested to learn more about how Yieldigo works in greater detail, you can reach out to us and book a demo with our pricing expert.