Covid, shaking supply chain, Russia invading Ukraine, shaking supply chain, inflation, shaking supply chain, energy crisis, shaking supply chain, government regulations, shaking supply chain, super-dynamic competitive market, shaking supply chain, thinner margins, cost cuttings, lay-offs…shaking supply chain.

This was daily bread in 2021–2022 for a major part of retail chain managers. For some, this was the last straw before finally getting a new pricing tool.

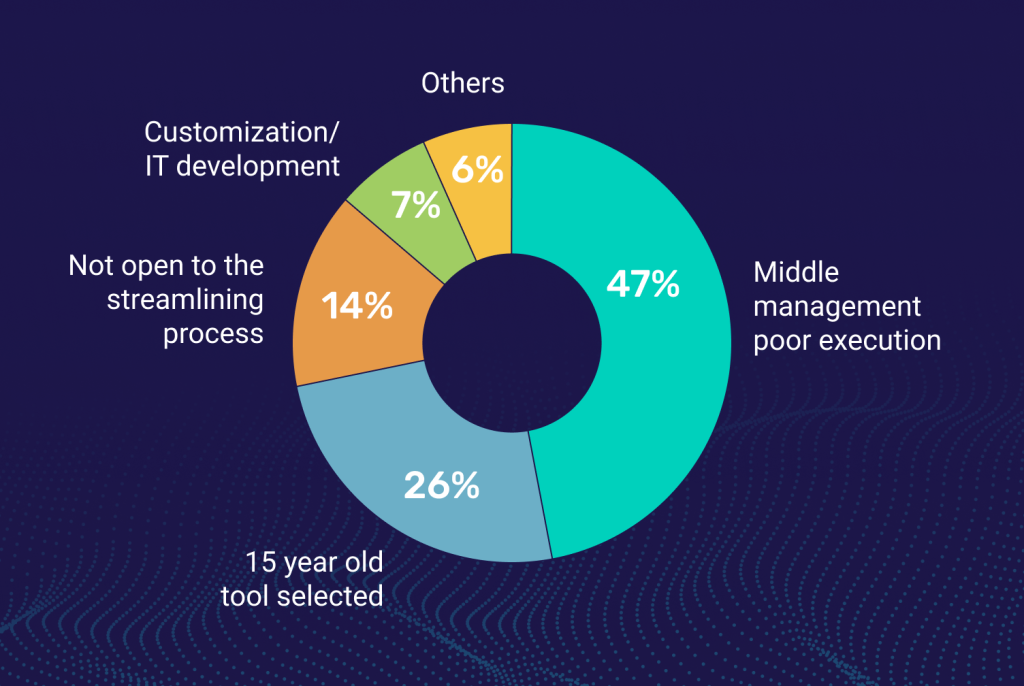

More than 200 retail CEOs, CCOs, Pricing Directors, Pricing Managers/Analysts, and Category Managers/Buyers spoke to us in 2022 to improve their pricing capabilities, as well as help them overcome the obstacles mentioned above. Roughly half of them have experienced some pricing tool implementation in their career. 8/10 have been experiencing serious issues that led to postponing or even canceling their projects. In other words – investment losses, management autonomy and reputation risk, waste of time, and opportunity losses. As this is a report, and not a book, we will get straight to the point and identify the factors that have been underestimated by retail CEOs, leading to notable issues.

My middle-management executed the change poorly-47%

You, as a top manager, think that your reportees have the same perspectives, intentions, and motives like you-not true!

-

- Middle management does the hard work around pricing, and they need you to see it.

- This way of thinking is extremely prone to blind alleys. They consider it a “success” to take the pricing burden a small step further than their predecessor. But, what if this is a blind alley?

- Top managers tend to do things at scale. They know the current pricing status quo might be risky and unideal, and that different pricing approaches could have moved the company up a notch or two. Middle managers tend to incrementally improve the current status quo, which is 100% suitable for pricing!

- The majority of middle managers are not willing to draw back from the blind alley for 4 reasons, primarily:

- They are not ready to abandon their last 5 years of work on their pricing machinery. And, by the way, have you ever asked if anyone else in the company understands their organization’s pricing machinery? Nobody? To all responsible top managers, this should sound very risky.

- By drawing back, they would essentially be admitting that for the last 5 years they have been on the wrong path, all while trying to convince you that it’s the right one. On top of it all, his decision to stay on the wrong path cost you and the business large amounts of time and money.

- When it comes to discussion around a new pricing tool, it‘s more beneficial for them to protect their current path. Typically, if they talk about a pricing tool, they tend to reduce the conversation to how they can only move a mere 5 meters ahead with it-thereby putting into question if a pricing tool will even pay off in this scenario. Meanwhile, they’re not open to hearing the fact that they should have moved 5 kilometers back first, and then 10 kilometers forward in 6 months.

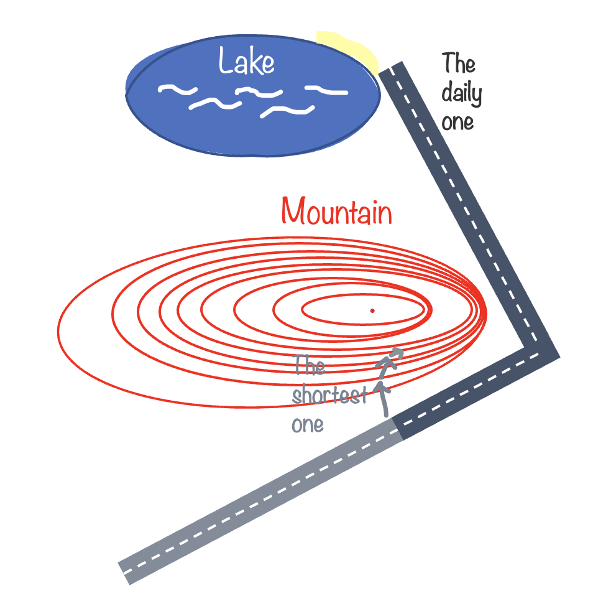

- Middle managers tend to take the hardest and shortest roads. On those long (and unnecessary) roads they can show you that they “work hard”.

Middle managers tend to take the hardest and shortest roads. On those long (and unnecessary) roads they can show you that they “work hard”.

-

- Retail chains without dedicated pricing teams are more vulnerable. Pricing tool adoption requires change management, and change management requires dedicated people with adequate buy-in. If you do not have a dedicated pricing person, hire one, nobody can do this job well as a side task!

We selected a 15-year-old pricing tool-26%

You’ve been advised to choose a 15-year-old tool to run automated data and machine-learning analytics with millions of transactions and thousands of SKUs. These capabilities have been on the retail tech market for five years, if that. Something is wrong here, right?

-

- Machine-learning wasn’t even available in retail tech 15 years ago. Therefore, pricing tools established back then couldn’t have this capability on the stack.

- In the last 5 years, top managers began to consider machine-learning as a must-have feature for automated data analytics to help them make excellent decisions, pricing included.

- Still today, old tools from 15 years ago don‘t have machine-learning options, and “somehow“ the business wants to add this capability to their stack. It simply doesn’t work-it would be like adding an electric engine to the front of a diesel car, and then putting the battery on the roof…, which cannot be called a functioning electric vehicle. Imagine how risky it would be for the stability of the car to have a battery on the roof. A new platform needs to be built from scratch, from the car industry perspective. Same with pricing SaaS and machine-learning capabilities!

- While the older tools are undergoing total replatforming nowadays, there have been multiple machine-learning and native pricing tools born in the last 5 years or so.

We were not ready to streamline our pricing processes-14%

Your top manager insists on referencing price A to price B as this was the routine over the last 10 years. Is he helping you make necessary changes, or just protecting himself from making any?

-

- Yes, linked to point 1.

- Example: Item price referencing = Issue!

- Middle managers tend to connect the price of one SKU to the price of another SKU. The reason is obvious – at the beginning it seems to be time-efficient!

- Same with store formats–hypermarkets are 3% cheaper than supermarkets (covering all assortments!).

- Same with geographical location-the countryside is 3% cheaper than the suburbs, which are 2% cheaper than non-capital cities, which are 1% cheaper than the capital itself.

- This results in prices of one operational part being totally linked to another operational part. All top managers know that this doesn’t reflect the reality of different regions, formats, channels, customers, categories, or SKUs, and it’s only a simplification made by middle management. We’ve never seen anyone who would be able to combine this flexibly with competitive intelligence and margin-setting rules. For example: “Hypermarkets are 3% cheaper than supermarkets covering the total assortment. And, 5% lower (at most), respectively above competition, with a margin above 22%. This is uncontrollable simply because competitive and margin rules only make sense in relation to specific assortment. For 10 departments: 40 categories, 300 subcategories; 1 simple rule becomes 10, 40 rules respectively become 3.000 rules to be manually managed, that have 30, 120, 9.000 and so forth more parameters compared to the original one. Therefore, most of the middle managers who use 100% price reference ability to make their life easier at the expense of margins, customer loyalty, and position in the market, typically end up with a simple rule: Hypermarkets are 3% cheaper than supermarkets covering total assortment.“

- Contrasting expectations can occur–full pricing automation vs. control example.

- Tony: “We can simulate and set our pricing strategy in the tool to further calculate our optimal prices for that strategy within the limits set by us.”

- Laura: “Can those limits be automatically optimized, and the best strategies automatically chosen too?”

- Tony: “I wouldn’t recommend it; we could easily face the risk of losing control.”

- Laura: 🤔

- Sometimes it takes a village for Tony and Laura to align their thinking, and streamline it alongside processes and responsibilities.

We required IT customizations for the new pricing tool-7%

Tailored IT development is fun, cool, easy, relatively affordable, and a good way to solve a problem–not at all!

-

- A usable pricing tool for any retail company will never ever be created by collecting every idea from the Commercial Department, BI/Data Department, Marketing Department, and Operations, declaring those as the definition for RFP/RFI/RFQ.

- How often are your middle managers asking SaaS Pricing vendors what they have learned from hundreds upon hundreds of tool implementations?

- SaaS Pricing vendors can guarantee quality, time, and costs for their solutions as is. With solutions that need IT development, your middle managers are putting all of this at risk, while wasting your time and money.

- If top managers want to mitigate this, they should invest time and energy into evaluating the best-fitting tool for their needs. If it is an 80% fit, it’s good enough; a 15% fit would typically mean it leads to a blind alley; and the remaining 5% can be subject to IT customizations, which is an absolute no-go. Top managers should be present when the new pricing tool is being selected to make sure they will not pay their margins for middle managers‘ comfort.

Others-6%

-

- Oftentimes this is an underestimation of internal resources, data quality, corporate/group buy-in, and internal relations.